323

Interest on syndicated loans all refers to the Company's share

of the Term Loan Facility 2011; the decrease compared with

2013 is mainly due to a reduction in interest expense following

early repayment of the Credit Agreement 2010 (see Note 10.

Borrowings from banks and other lenders).

Amortisation of bank and financial fees and other expenses

mainly reflects the Company's share of the fees relating

to the Credit Agreement 2011 and to the convertible and

non-convertible bonds.

Non-recurring finance costs mainly refer to the accelerated

amortisation of bank fees following early repayment of the

Credit Agreement 2010 (see Note 10. Borrowings from banks

and other lenders).

Other bank interest mainly refers to the new credit lines in the

form of the EIB Loan (Euro 1,198 thousand) and the Revolving

Credit Facility 2014 (Euro 723 thousand).

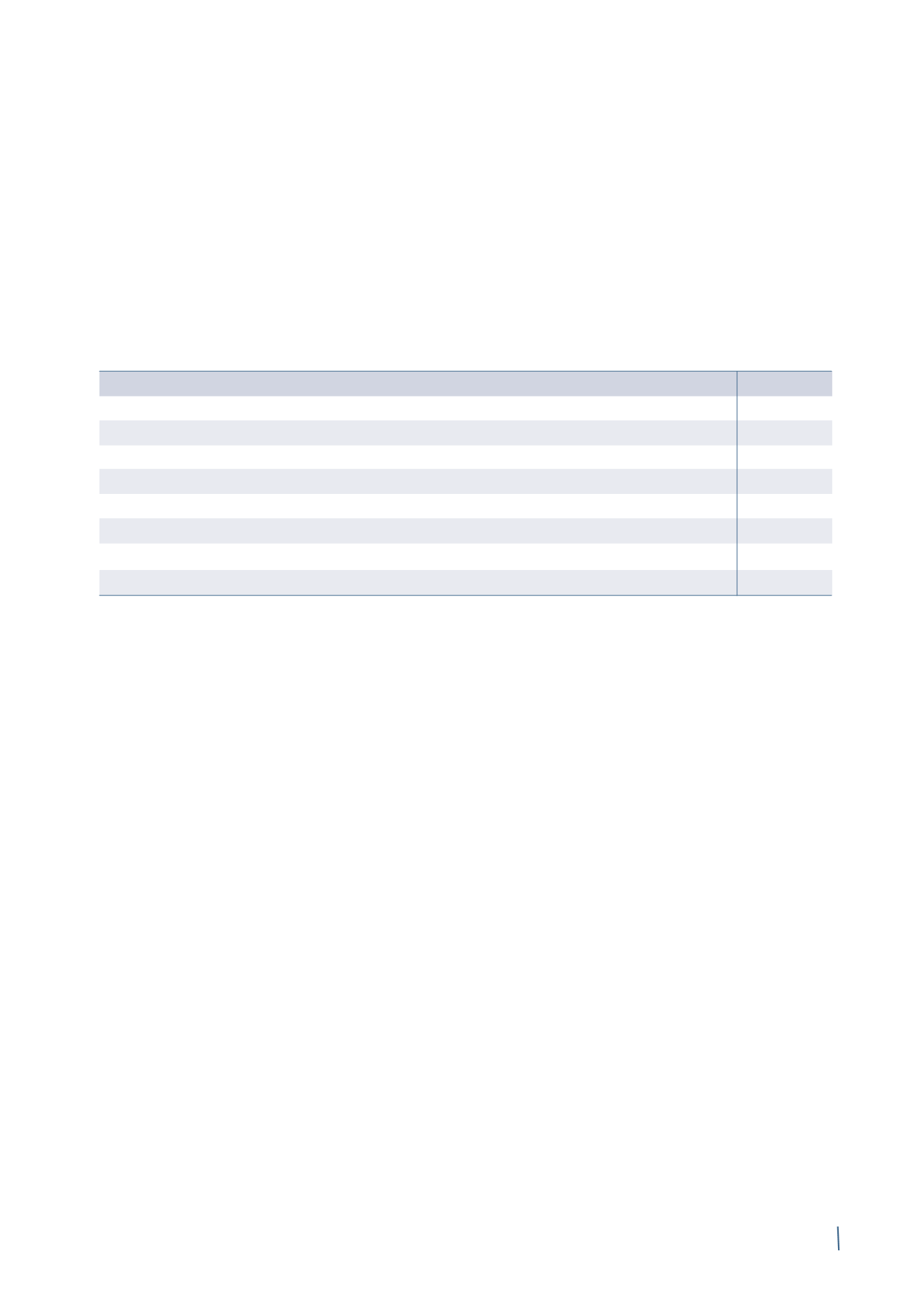

Finance income is detailed as follows:

2014

2013

Interest income from banks and other financial institutions

7

2

Other finance income

16,108

13,085

Non-recurring other finance income:

Recovery of Antitrust guarantee costs

258

-

Total non-recurring other finance income

258

-

Finance income

16,373

13,087

Foreign currency exchange gains

3,179

1,461

Total finance income

19,552

14,548

Other finance income mainly refers to the recharge to Group companies of fees for guarantees given by the Company on their

account.

During 2014, Prysmian S.p.A. earned a total of Euro 221,071 thousand in dividends, most of which from its subsidiaries Prysmian

Cavi e Sistemi S.r.l. and Prysmian PowerLink S.r.l..

21.

DIVIDENDS FROM SUBSIDIARIES

(in thousands of Euro)