Parent Company Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

324

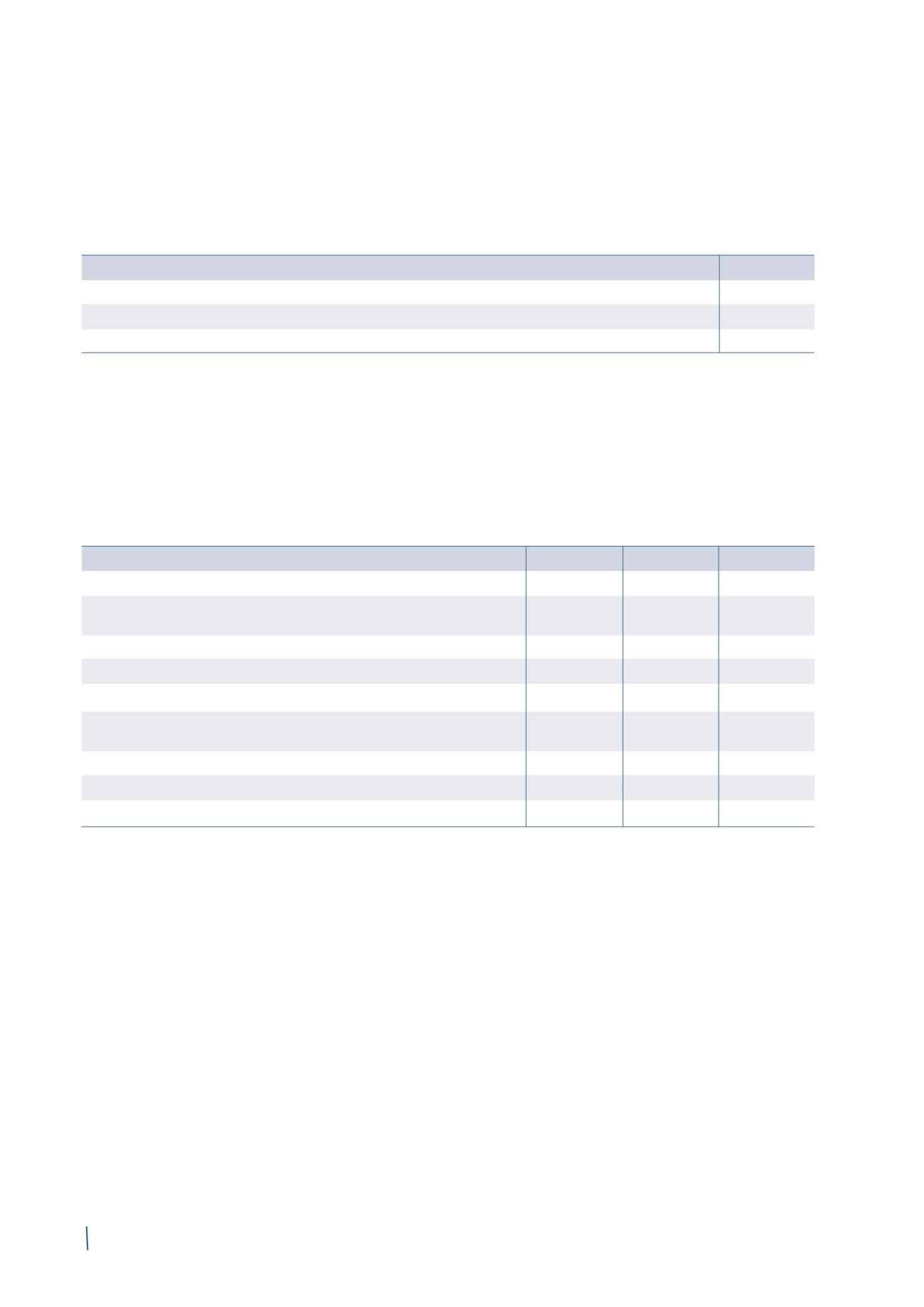

These are detailed as follows:

22. TAXES

2014

2013

Current income taxes

(17,499)

(31,091)

Deferred income taxes

1,363

2,847

Total

(16,136)

(28,244)

Current income taxes report a positive Euro 17,499 thousand

in 2014, compared with Euro 31,091 thousand in 2013, and

mainly reflect the net positive effects of the relief provided by

tax losses transferred from some Italian companies under the

rules of the group tax consolidation.

Information about deferred taxes can be found in Note 4.

Deferred tax assets.

Taxes charged on profit before taxes differ from those calcu-

lated using the theoretical tax rate applying to the Company

for the following reasons:

2014

Tax rate

2013

Tax rate

Profit before taxes

175,420

156,441

Theoretical tax expense at

Parent Company's nominal tax rate

48,241

27.5%

43,021

27.5%

Dividends from subsidiaries

(57,755)

(32.9%)

(57,439)

(32.7%)

Other permanent differences

(2,812)

(1.6%)

407

0.2%

Tax credit paid abroad

(186)

(0.1%)

(8,192)

(4.7%)

Impairment/(Reversal of impairment)

of investments in subsidiaries

4,528

2.6%

-

0.0%

Other

(1,985)

(1.1%)

1,237

0.7%

Net effect of group tax consolidation for the year

(6,168)

(3.5%)

(7,278)

(4.1%)

Effective income taxes

(16,136)

(9.2%)

(28,244)

(16.1%)

Since 2006 the Company, along with all its Italian resident sub-

sidiaries, has opted to file for tax on a group basis, pursuant to

art. 117 et seq of the Italian Income Tax Code, with the Company

acting as the head of this group. The intercompany transac-

tions arising under such a group tax consolidation are governed

by specific rules and an agreement between the participating

companies, which involve common procedures for applying the

tax laws and regulations.

These rules were updated in 2008 to reflect the amendments

and additions introduced by Law 244 of 24 December 2007

(Finance Act 2008) and Legislative Decree 112 of 25 June 2008.

These rules were amended on 26 March 2012 to incorporate in

the transactions between the head of the tax group and the in-

dividual participating companies, the amendments introduced

by Legislative Decree 201/2011 and the Ministerial Decree dated

14 March 2012 concerning Aid for Economic Growth.

(in thousands of Euro)

(in thousands of Euro)