Parent Company Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

330

demand full or partial repayment of the amounts lent and

not yet repaid, together with interest and any other amount

due. No collateral security is required.

Actual financial ratios reported at period end, calculated at

a consolidated level for the Prysmian Group, are as follows:

• occurrence of events that may adversely and significantly

affect the business, the assets or the financial conditions

of the Group.

Should a default event occur, the lenders are entitled to

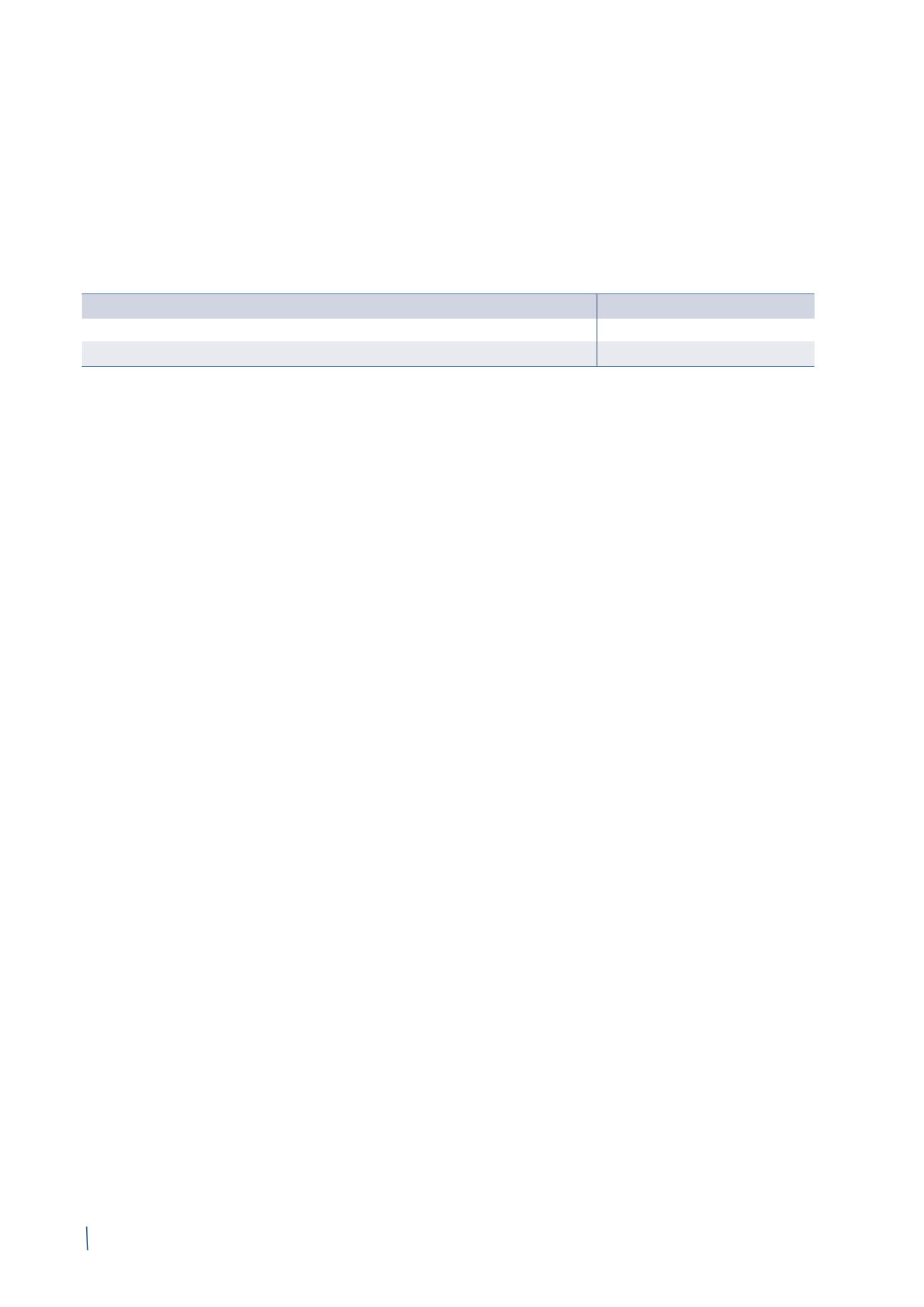

31 December 2014

31 December2013 (*)

EBITDA / Net finance costs

(1)

5.82

6.99

Net financial position / EBITDA

(1)

1.50

1.27

(*) The ratios are calculated on the basis of the definitions contained in the relevant agreements.

(1) The financial covenants have been recalculated following restatement of the previously published figures for the adoption of IFRS 10 and 11, the adoption of

a new method of classifying the share of net profit/(loss) of associates and joint ventures and of different timing for recognising the cash component of the

2011-2013 incentive plan.

instances of non-compliance with the financial and non-fi-

nancial covenants indicated above.

The above financial ratios comply with both the covenants

contained in the relevant credit agreements and there are no

excluding these items, net cash finance costs reflected in the

statement of cash flows amounted to Euro 18,135 thousand,

most of which referring to interest expense, bank fees and

other incidental expenses in connection with the Credit

Agreement 2011, the EIB Loan, the convertible bond and the

non-convertible bond.

Net cash flow used by financing activities includes the

receipt of the EIB Loan and the early repayment of the Credit

Agreement 2010.

Net cash flow used by operating activities was a negative Euro

56,726 thousand in 2014, inclusive of Euro 18,701 thousand

in taxes collected by the Group's Italian companies for IRES

transferred under the group tax consolidation (art. 117 et seq

of the Italian Income Tax Code).

Investing activities provided a net positive Euro 89,947

thousand in cash flow, after collecting Euro 221,071 thousand

in dividends from subsidiaries.

Net finance costs recognised in the income statement

came to Euro 38,862 thousand inclusive of non-cash items;

30. STATEMENT OF CASH FLOWS