329

other types of remuneration, pension and medical benefits,

received for their service as directors or statutory auditors of

Prysmian S.p.A.. Further details can be found in the Remu-

neration Report.

Directors' compensation amounts to Euro 4,477 thousand in

2014, and Euro 11,503 thousand in 2013. Statutory auditors'

compensation for duties performed in Prysmian S.p.A.

amounts to Euro 175 thousand in 2014 (Euro 175 thousand

in 2013). Compensation includes emoluments, and any

27.

COMPENSATION OF DIRECTORS AND STATUTORY AUDITORS

In accordance with the disclosures required by Consob Communication DEM/6064293 dated 28 July 2006, it is reported that no

atypical and/or unusual transactions took place during the year.

28. ATYPICAL OR UNUSUAL TRANSACTIONS

a) Financial covenants

• Ratio between EBITDA and Net finance costs (as defined

in the relevant agreements);

• Ratio between Net Financial Position and EBITDA (as

defined in the relevant agreements).

The covenants contained in the various credit agreements are

as follows:

The credit agreements in place at 31 December 2014, details

of which are presented in Note 10. Borrowings from banks

and other lenders, require the Group to comply with a series

of covenants on a consolidated basis. The main covenants,

classified by type, are listed below:

29. GROUP FINANCIAL COVENANTS

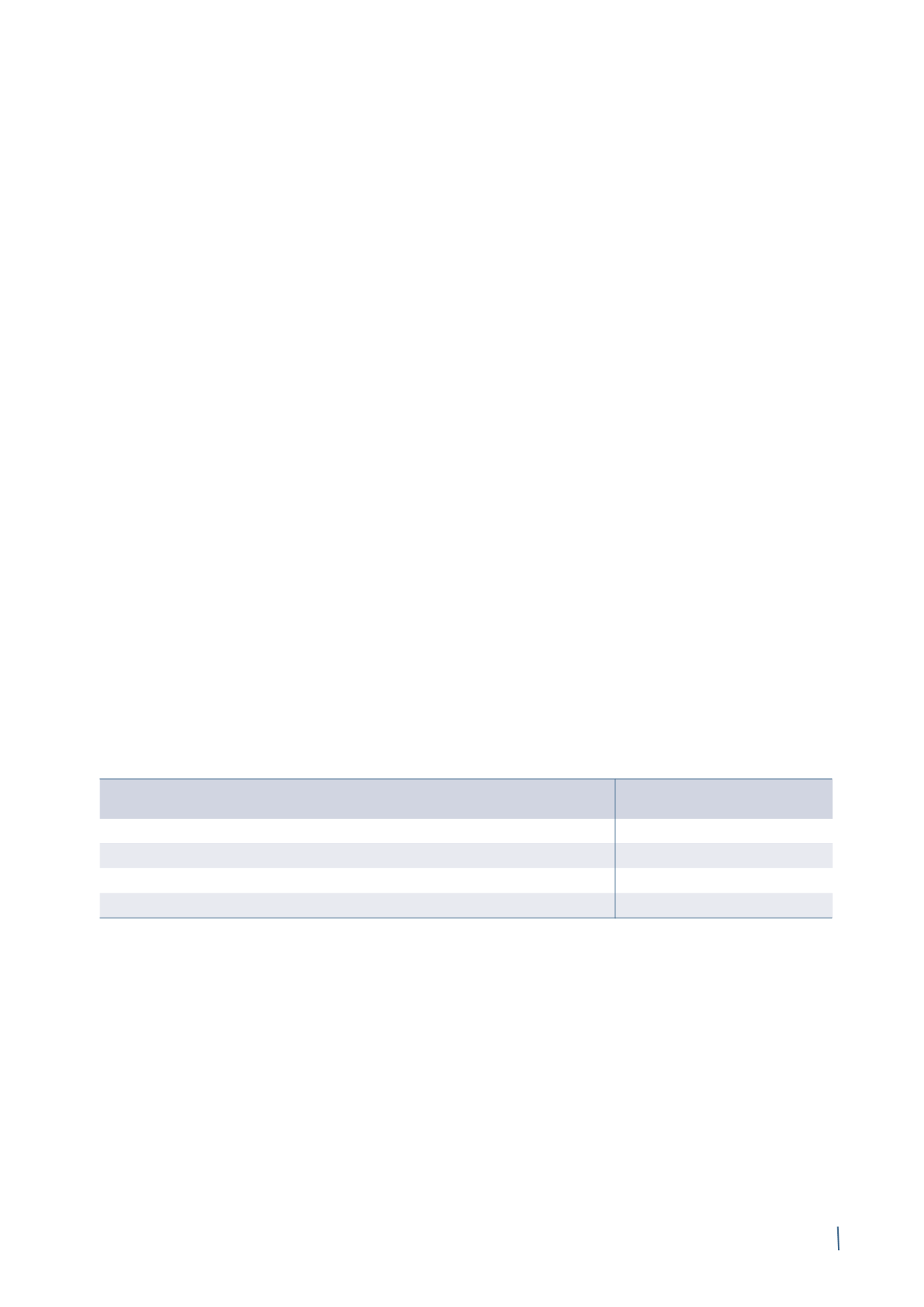

EBITDA/Net finance costs (*)

Net financial position/EBITDA (*)

not less than

not more than

Credit Agreement 2011

5.50x

2.50x

EIB Loan

5.50x

2.50x

Credit Agreement 2014

4.00x

3.00x

Revolving Credit Facility 2014

4.00x

3.00x

Default events

The main default events are as follows:

• default on loan repayment obligations;

• breach of financial covenants;

• breach of some of the non-financial covenants;

• declaration of bankruptcy or subjection of Group

companies to other insolvency proceedings;

• issuance of particularly significant judicial rulings;

b) Non-financial covenants

A number of non-financial covenants have been established

in line with market practice applying to transactions of a

similar size and nature. These covenants involve a series

of restrictions on the grant of secured guarantees to third

parties, on the conduct of acquisitions or equity transactions,

and on amendments to the Company's by-laws.

(*) The ratios are calculated on the basis of the definitions contained in the relevant agreements.