325

PrysmianS.p.A. acts as the head of the tax group and calculates

a single taxable base for companies in the Italian tax group; this

has the benefit of being able to offset taxable profits against

tax losses in a single tax return, thereby ensuring optimisation

of the tax charge.

On 7 June 2012, the head of the tax group sent the required

notice of renewal of the group tax election for the three years

2012 – 2013 – 2014 for the following companies:

• Fibre Ottiche Sud – F.O.S. S.r.l.

• Prysmian Cavi e Sistemi S.r.l.

• Prysmian Cavi e Sistemi Italia S.r.l.

• Prysmian Treasury S.r.l.

This notice also included the election to include Prysmian

Electronics S.r.l. in the group tax consolidation with effect

from 2012.

Prysmian PowerLink S.r.l. renewed its election to file for tax

on a group basis for the three years 2014 - 2015 – 2016 on 3

June 2014.

The rate used to calculate the tax charge is 27.5% for IRES

(Italian corporate income tax), and 5.57% for IRAP (Italian

regional business tax).

As a global operator, the Company is exposed to legal risks

primarily, by way of example, in the areas of product liability,

and environmental, antitrust and tax rules and regulations.

Outlays relating to current or future proceedings cannot be

predicted with certainty. The outcome of such proceedings

could result in the payment of costs that are not covered, or

23. CONTINGENT LIABILITIES

not fully covered, by insurance, which would therefore have a

direct effect on the Company's financial position and results.

It is also reported, with reference to the Antitrust investi-

gations in the various jurisdictions involved, that the only

jurisdiction for which Prysmian S.p.A. has been unable to

estimate the related risk is Brazil.

The Company has the following types of commitments at 31

December 2014:

a) Commitments to purchase property, plant and equipment

and intangible assets

Contractual commitments, already given to third parties at

31 December 2014 and not yet reflected in the financial state-

ments, amount to Euro 3,276 thousand (Euro 941 thousand

24. COMMITMENTS

at 31 December 2013), of which Euro 402 thousand in relation

to the SAP Consolidation project (Euro 264 thousand at 31

December 2013).

b) Operating lease commitments

Future commitments relating to operating leases are as

follows:

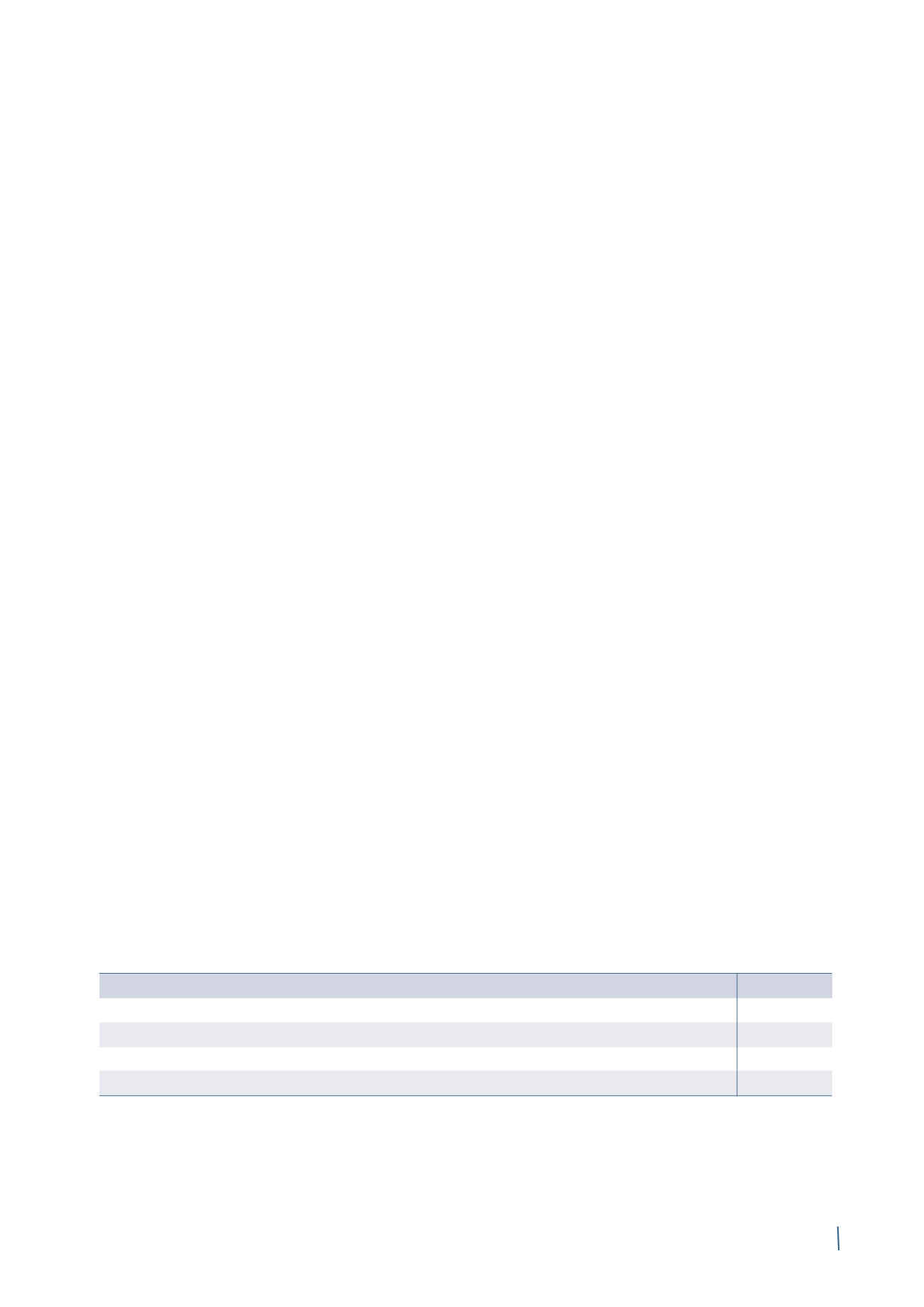

2014

2013

Due within 1 year

3,804

2,175

Due between 1 and 5 years

5,580

2,029

Due after more than 5 years

66

-

Total

9,450

4,204

(in thousands of Euro)