Parent Company Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

326

c) Comfort letters in support of bank guarantees given to

Group companies

Comfort letters in support of bank guarantees given in the

interest of Group companies amount to Euro 70 thousand at

31 December 2014, all of which relating to P.T. Prysmian Cables

Indonesia (Euro 73 thousand at 31 December 2013).

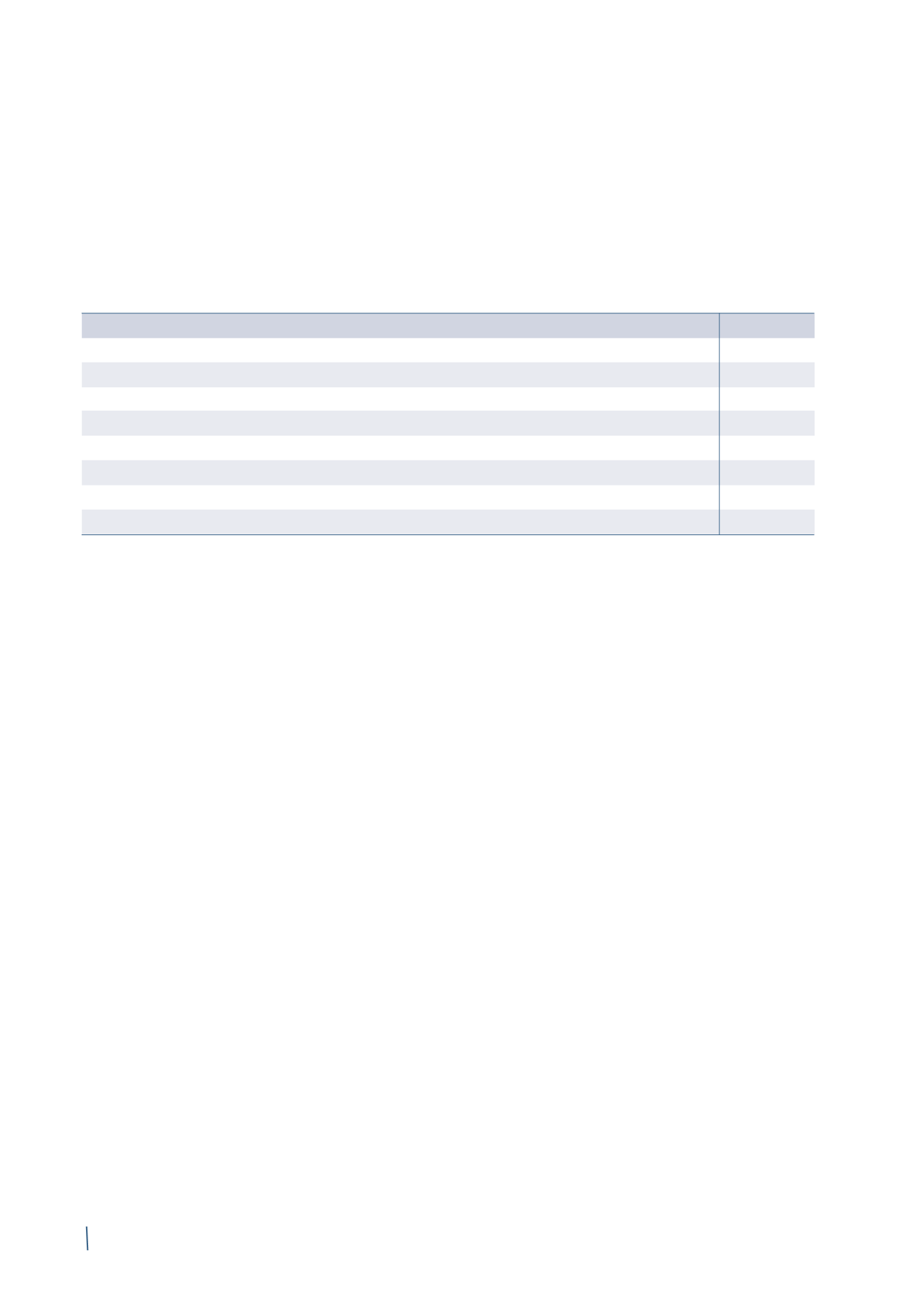

d) Other guarantees given in the interest of Group companies

These amount to Euro 1,005,862 thousand at 31 December

2014 (Euro 961,456 thousand at 31 December 2013), analysed

as follows:

2014

2013

Prysmian Cavi e Sistemi S.r.l.

56,641

42,766

Prysmian Netherlands B.V.

65,643

47,740

Prysmian PowerLink S.r.l.

848,881

837,246

Prysmian Cables & Systems Limited

25,422

23,750

Prysmian Kabel und Systeme GmbH

242

242

Fibre Ottiche Sud - F.O.S. S.r.l.

7,965

7,712

Other companies

1,068

2,000

Total

1,005,862

961,456

The comfort letters and guarantees given in the interest of

Group companies in (c) and (d) mainly refer to projects and

supply contracts and to the offsetting of VAT credits under

the Group VAT settlement.

e) Comfort letters in support of bank guarantees given in

the interest of the Company

These amount to Euro 54,424 thousand, compared with Euro

2,124 thousand in the prior year. The increase mainly reflects

the guarantees given in the interest of Prysmian S.p.A. and

Prysmian Cavi e Sistemi S.r.l. to the European Commission for

the fine discussed in Note 12. Provisions for risks and charges.

As required by art. 2427 point 22-ter, it is reported that,

in addition to the above disclosures about commitments,

there are no other agreements that are not reflected in the

statement of financial position that carry significant risks or

benefits and which are critical for assessing the Company's

assets and liabilities, financial position and results of oper-

ations.

Transactions between Prysmian S.p.A. and its subsidiaries

mainly refer to:

• services (technical, organisational and general) provided

by head office to subsidiaries;

• charging of royalties for the use of patents to Group

companies that benefit from them;

• financial relations maintained by the Parent Company on

behalf of, and with, Group companies.

25. RELATED PARTY TRANSACTIONS

All the above transactions fall within the ordinary course of

business of the Parent Company and its subsidiaries.

The disclosures of related party transactions also include the

compensation paid to Directors, Statutory Auditors and Key

Management Personnel.

More details about related party transactions are provided in

the attached table "Intercompany and related party transac-

tions (disclosure under art. 2428 of the Italian Civil Code)".

(in thousands of Euro)