Outlook

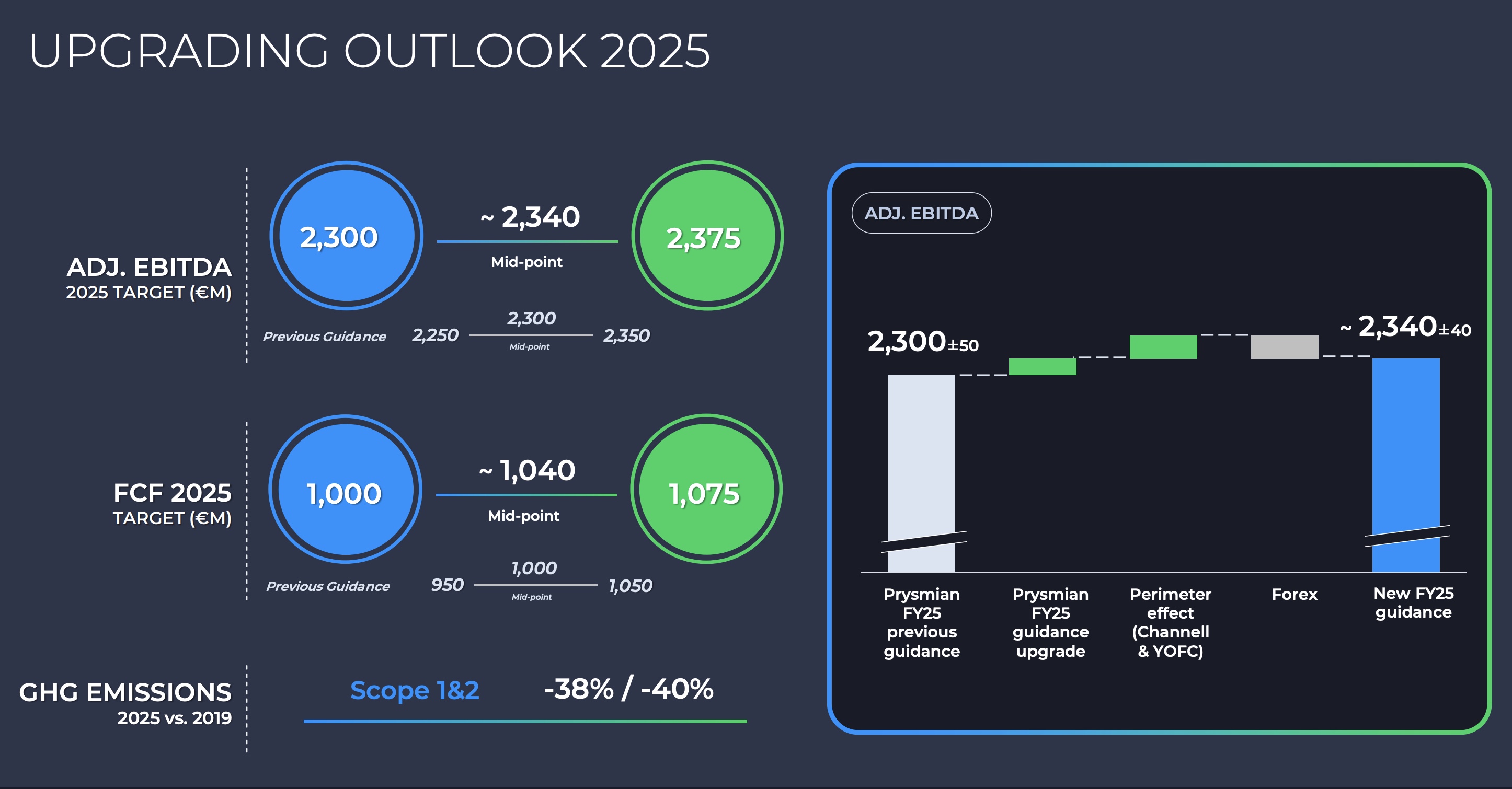

Based on the strong performance in the first half of the year, together with the contribution from Channell (which was fully consolidated as of June 1 2025), Prysmian has decided to upgrade its guidance for FY25, despite headwinds arising from changes in the EUR/USD exchange rate in respect to that of February 2025:

o Adjusted EBITDA in the range of €2,300-2,375 million;

o Free cash flow in the range of €1,000-€1,075 million;

o Scope 1&2 GHG emission reductions in the range of -38% and -40% vs 2019.

This guidance assumes no material changes in the geopolitical situation, in addition to excluding extreme dynamics in the prices of production factors or significant supply chain disruptions (assuming no further significant changes in tariffs). The forecasts are based on the Company's current business perimeter, for a newly set EUR/USD exchange rate of 1.14, compared to the previous 1.06, and do not include impacts on cash flows related to Antitrust issues.