FILING OF A LIST OF CANDIDATES FOR THE RENEWAL OF THE BOARD OF STATUTORY AUDITORS

With reference to the Shareholders’ Meeting of Prysmian S.p.A. (the "Company") convened in single call that will take place in Ordinary and Extraordinary session on 16 April 2025 (the "Shareholders’ Meeting"), it should be noted that a list of candidates for the renewal of the Company's Board of Statutory Auditors was filed today.

The list of candidates, filed by means of a communication received at the Company's registered e-mail address, [email protected], was presented jointly by the shareholders:

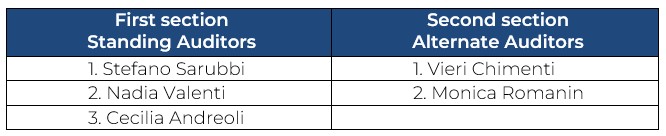

Algebris Ucits Funds Plc - Algebris Core Italy Fund; Amundi Asset Management SGR S.p.A. manager of the funds: AIF - MULTIASSET TEODORICO, AIF - EMU EQUITY, ASI - Bilanciato Percorso ATT III, AIF - European Equity, Core Pension Garantito ESG, Core Pension Azionario Plus 90% ESG, Core Pension Azionario 75% ESG, Core Pension Bilanciato 50% ESG, Amundi Bilanciato Piu, Seconda Pensione Garantita ESG, Seconda Pensione Prudente ESG, Seconda Pensione Espansione ESG, Seconda Pensione Bilanciata ESG, Seconda Pensione Sviluppo ESG, Amundi Risparmio Italia, Amundi Sviluppo Attivo Italia, Amundi Obblig Piu A Distribuzione, Amundi Impegno Italia – B, Amundi ESG Selection Dinamico, Amundi ESG Selection Bilanciato, Amundi ESG Selection Conservativo, Amundi Luxembourg S.A. – AF NET ZERO AMB TOP EUR PLAY, Amundi Luxembourg S.A. – A-F EUROLAND EQ; Anima Sgr S.P.A. manager of the fund Anima Italia; APG Asset Management N.V. manager of the funds: 2122 ABP DME CORE INT, 2124 ABP DME CORE BLACKROCK, 2120 ABP DME SATELLITE NORDEA, 1217 APG DME INDUSTR, 1253 APG DME CORE EU, 2049 APG DME ARROWST, 2125 ABP DME CORE UBS, 5253 PGIM EURO IG FOR SPW; Arca Fondi Sgr S.P.A. manager of the fund Fondo Arca Azioni Italia; AXA Investment Managers Paris manager of the fund AXA WF Italy Equity; BancoPosta Fondi S.p.A. SGR manager of the funds: Bancoposta Global Optimal Multiasset, Bancoposta Long-Term Optimal Multiasset, Bancoposta Strategic Insurance Distribution, Bancoposta Distribuzione Attiva, Bancoposta Azionario Flessibile, Bancoposta Rinascimento, Bancoposta Global Equity Hedged Lte, Bancoposta Equity Developed Countries, Bancoposta Equity All Country; BNP Paribas Asset Management; Etica Sgr S.p.A. manager of the funds: F.do Etica Obbligazionario Misto, F.do Etica Rendita Bilanciata, F.do Etica Bilanciato, F.do Etica Azionario, F.do Etica Impatto Clima; Eurizon Capital S.A. manager of the fund Eurizon Fund comparti: Equity Innovation, Italian Equity Opportunities, Equity Small Mid Cap Europe, Sustainable Multiasset, Equity Italy Smart Volatility, Equity Euro LTE, Equity Europe LTE, di Eurizon AM SICAV comparto Global Equity, di Eurizon Next 2.0 comparto Strategia Azionaria Flessibile, di Eurizon Investment SICAV comparto Sustainable Equity Europe; Eurizon Capital SGR S.p.A manager of the funds: Epsilon Step 30 Megatrend Esg Settembre 2027, Epsilon Step 30 Megatrend Esg Giugno 2027, Epsilon Step 30 Megatrend Esg Dicembre 2027, Epsilon Step 30 Megatrend Esg Dicembre 2027 – Edizio, Epsilon Step 30 Megatrend Marzo 2028, Eurizon Step 70 Pir Italia Giugno 2027, Eurizon Am Bilanciato Etico, Eurizon Am Rilancio Italia Tr, Eurizon Thematic Opportunities Esg 50 Luglio 2026, Eurizon Flessibile Azionario Maggio 2027, Eurizon Flessibile Azionario Giugno 2027, Eurizon Flessibile Azionario Dicembre 2024, Eurizon Pir Italia Azioni, Eurizon Azioni Italia, Eurizon Azionario Internazionale Etico, Eurizon Flessibile Azionario Marzo 2026, Eurizon Flessibile Azionario Maggio 2025, Eurizon Flessibile Azionario Luglio 2025, Eurizon Flessibile Azionario Settembre 2025, Eurizon Flessibile Azionario Dicembre 2025, Eurizon Flessibile Azionario Maggio 2026, Eurizon Flessibile Azionario Giugno 2026, Eurizon Approccio Contrarian Esg, Eurizon Flessibile Azionario Settembre 2026, Eurizon Flessibile Azionario Dicembre 2026, Eurizon Flessibile Azionario Marzo 2027, Eurizon Progetto Italia 70, Eurizon Progetto Italia 40, Eurizon Flessibile Azionario Marzo 2025; Fidelity Funds - Multi Thematic Pool; Fideuram Asset Management Ireland manager of the fund Fonditalia Equity Italy; Fideuram Intesa Sanpaolo Private Banking Asset Management Sgr S.p.A. manager of the funds: Fideuram Italia, Piano Azioni Italia, Piano Bilanciato Italia 30, Piano Bilanciato Italia 50; Interfund Sicav - Interfund Equity Italy; Generali Asset Management S.p.A. Società di Gestione del Risparmio, as delegated manager in the name and on behalf of: Alleanza Alto ESG Internazionale Azionario, GF Europe Megatrends ISR, Generali Investments SICAV Sustainable World Equity, Generali Diversification Global Asset Allocation Fund, GIS Absolute Return Multi Strategies, Generali Smart Funds PIR Valore Italia, Generali AktivMixDynamik Pro80, Generali Investments SICAV Euro Equity, Generali Investments SICAV Euro Future Leaders, Generali Smart Fund PIR Evoluzione Italia; Kairos Partners Sgr S.p.A. as Management Company di Kairos International Sicav – Comparti: Italia, Patriot, Made in Italy and Opportunities Long Short; Legal & General Assurance (Pensions Management) Limited; Mediobanca SGR S.p.A. manager of the fund Mediobanca Italian Equity All Cap; Mediolanum International Funds Limited – Challenge Funds – Challenge Italian Equity, Mediolanum Gestione Fondi Sgr S.P.A. manager of the funds: Mediolanum Flessibile Futuro Italia and Mediolanum Flessibile Sviluppo Italia, owners of 8,510,442 ordinary shares (as of today evidenced by bank certifications received by the Company for 6,884,475) equal to 2,8772% of the share capital of Prysmian S.p.A., and composed as follows:

The documentation relating to the aforementioned list and to the candidate statutory auditors will be made available to the public within the terms and according to the procedures provided for by current legislation.