A closer look at fibre penetration in APAC, EU and the USA

Global gigabit subscriptions are expected to hit 50 million in 2022, more than doubling from 24 million at the end of 2020.1 However, although global FTTH subscriptions continue to grow, especially in Europe, and the Americas, fibre penetration remains lower than 50% in many countries and large discrepancies exist within regions.2 Let’s take a closer look at developments in EU, APAC and the USA.

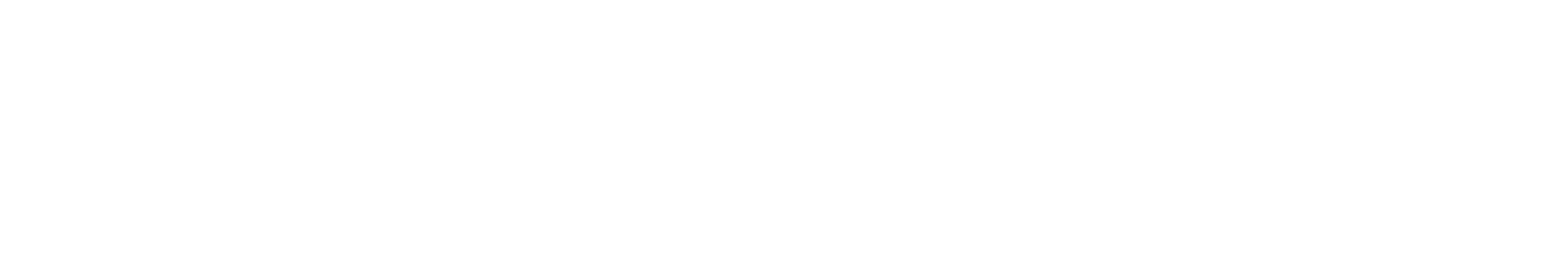

USA

In 2021, the US had 23.4 wired broadband subscriptions per 100 inhabitants.2

FTTH will pass 82 million American households by 2027, nearly twice as many as today. The four largest telcos plan to be pass over 71 million homes with fibre. FTTH's share of the broadband market is expected to grow from the current 14% to 26% in that time, as the total addressable market expands. US broadband penetration could exceed 90% driven by lockdowns, government funding (over $130 billion) and the lower cost of capital.3

Leading providers including Verizon Communications Inc., AT&T Inc. and cableco Altice USA Inc. should be adding nearly 23 million FTTP addresses by 2023.5 However, with 14.6% fixed broadband subscribers at the end of 2021 North America lags all other regions when it comes to FTTP adoption. Several reasons can be given for this, including:

- Slow fibre deployments and an initial focus on FTTC

- Uptake of DOCSIS 3.1.4

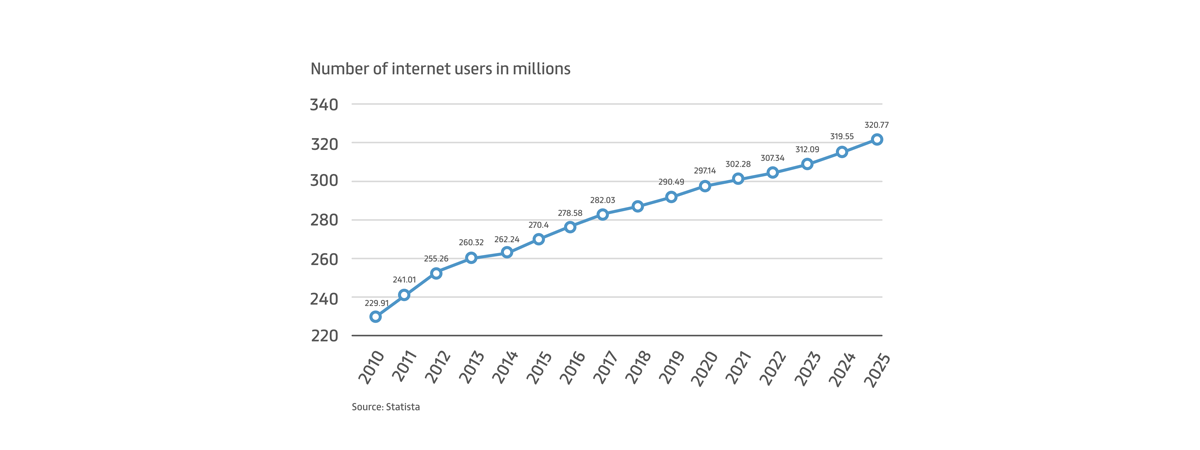

APAC

In 2021, the Asia & Pacific region had 16.7 wired broadband subscriptions per 100 inhabitants.

Broadband subscriptions amounted to 727 million, over 60 million higher than the previous year.2

FTTH/B service is set to be leading fixed broadband technology in APAC, accounting for 94.8 per cent of the region’s total fixed broadband service revenue by 2026.

The number of fibre lines as part of the total fixed broadband lines in APAC is expected to grow from 672.2 million (90.7%) in 2021 to 792 million (92.5%) by 2026. Growing demand for high-speed Internet services, fibre rollouts and national broadband networks in most APAC countries are driving this.

It is interesting to note that China’s broadband penetration will increase from 35.9% in 2021 to 3% in 2026 supported by the ongoing broadband network coverage expansions by major operators.6

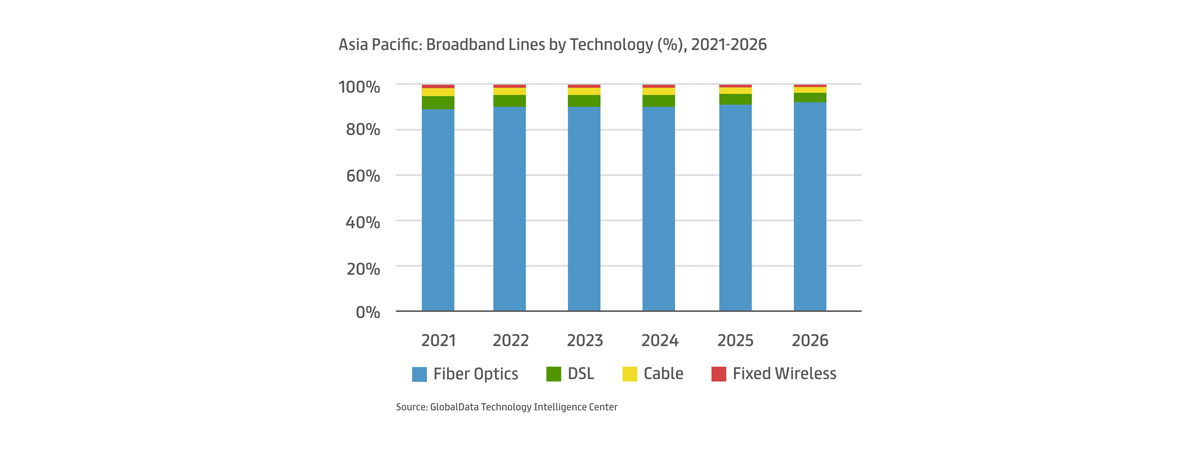

EUROPE

In 2021, Europe had the world’s highest rate of wired broadband subscriptions at 34.7 per 100 inhabitants.2

Some 47% of all homes that can get full-fibre broadband take out a subscription. FTTH/B subscribers are likely to grow to 197mn by the end of 2026 from 99mn at the end of 2021.7

Ambitious Digital Agenda goals and demand for broadband speed and bandwidth driven by COVID-19 lockdowns, have accelerated FTTP network deployments and service take-up in the European Union. In Western Europe, migration to fibre is accelerating, with fibre projected to overtake xDSL by 2025 with a 40.7% market share. In Eastern Europe — where both telcos and cable operators in most markets deployed FTTP — nearly 52% of fixed broadband subscribers were using fibre by the end of 2021.4 The European Commission has commended the improvement in ‘very high-capacity networks’ (VHCN), now available in 59% of households in the EU, up from 50% a year ago.

SOURCES:

1 Omdia

2 Statista

3 Cowen analysts

4 SP Global

5 Kagan

6 GlobalData

7 FTTH Council Europe