Risk and Opportunity Management

Overview

Prysmian’s value creation policy has always been based on effective risk and opportunity management. Since 2012, by adopting the provisions on risk management introduced by the Corporate Governance Code for Listed Companies (Corporate Governance Code) of Borsa Italiana, Prysmian has taken the opportunity to strengthen its governance model and implement an evolving risk management system that promotes proactive management of risks and opportunities using a structured and systematic tool to support the main business decision-making processes.

In fact, this Enterprise Risk Management (ERM) model, developed in line with internationally recognised models and best practices, such as those promoted by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) and the ISO 31000 standard, enables the Board of Directors and managers to make informed assessments of risk scenarios that could jeopardise the achievement of strategic objectives. It also allows to adopt additional tools able to anticipate, mitigate and manage significant exposures and to pursue opportunities in line with the Group’s risk appetite, defined as the type and extent of risk that Prysmian is able and willing to assume.

The risk and opportunity management process involves the Group’s key business/function managers, allowing the most significant risk factors to be identified, assessed and managed, including sustainability and climate-related issues. This results in an integrated and multi-disciplinary company-wide risk management process aimed at ensuring long-term value creation for shareholders and stakeholders.

ERM in practice

The Group Chief Risk and Compliance Officer, tasked with managing the ERM system, is responsible for ensuring, together with top management, that the main risks and opportunities for Prysmian and its subsidiaries are promptly identified, assessed, treated and monitored over time.

After reporting to an internal risk management committee consisting of the Group’s top managers, the Group Chief Risk and Compliance Officer periodically meets the Control and Risks Committee — made up of non-executive members of the Board of Directors — to provide updates on the outcomes of the analyses conducted and actions taken, as well as about any developments in the Group’s ERM process.

Prysmian’s risk appetite

Prysmian’s risk appetite is determined through a process that defines the types and extent of risk that the Company is able and willing to assume in pursuing its strategic objectives.

Identifying risks and setting a clear risk appetite level are essential to achieving an effective ERM framework.

Prysmian has not set a single risk appetite statement but rather applies different risk appetite levels based on the range of its activities, and may choose to accept different degrees of risk in different areas. For instance, a “Zero tolerance” risk appetite is set for legal & compliance risks (e.g.; non-compliance to export control laws and risk related to the whistleblowing system) and for HSE related matters, while a “Low tolerance” risk appetite is set for Cyber risk.

Risk and opportunity governance

Managing risks and opportunities is an essential part of Prysmian’s culture and fosters greater confidence in achieving strategic objectives and making the business sustainable, together with creating value for all employees, shareholders and stakeholders.

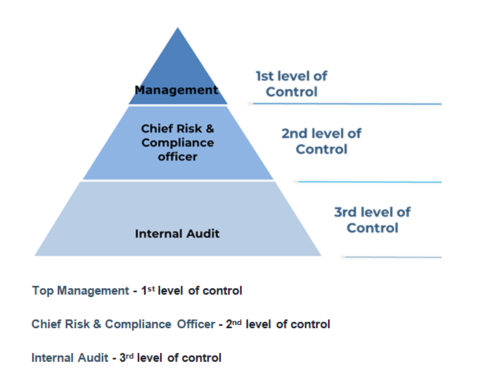

Developing, implementing and promoting a risk and opportunity control and management assurance system is based on the integration of different levels of control:

The ERM process is generally conducted at least twice a year in order to identify, assess, treat and monitor risks and opportunities to ensure that the Group risk exposure is reviewed on a regular basis. For the most relevant risks, for emerging and / or evolving risks, assessment activities are performed even more frequently.

Prysmian’s risk and opportunity culture

In order to promote an effective risk and opportunity culture throughout the organisation Prysmian has adopted dedicated strategies, including:

- regular risk and opportunity management education and awareness for all Board members (e.g., the Risk Management & Compliance function regularly updates the Control and Risks Committee about the progress made by the Group’s ERM process and by the various risk management activities) providing deep-dives, inductions and training as needed;

- training focused on risk and opportunity management principles for the whole organisation (e.g., e-learning training through an internal platform);

- dedicated series of training on operational risks (e.g., Project Risk Management) and induction sessions on risk management for new joiners;

- integration of risk and opportunity criteria into the development of products / projects / and services (e.g., risk analysis and deep dives embedded into product and process development, as well as into the bidding and delivery processes);

- financial incentives that incorporate risk management metrics (e.g., the Prysmian Performance evaluation and development programs).

Risk and opportunity identification

Toggle DetailsPrysmian’s ERM aims to identify to all types of potentially significant risks and opportunities for the Group, as outlined in its Risk Model — shown in the figure below —, which classifies the internal and external risks of Prysmian’s business model based on five families:

Risk and opportunity assessment

Toggle DetailsERM process requires Prysmian Management to use of a clearly defined, common method to assess the Group exposure, to specific risk and opportunity events, measured in terms of impact, likelihood and adequacy of the existing level of risk management, meaning:

- Economic-financial impact on expected EBITDA or cash flows, net of any insurance coverage and countermeasures in place, and/or impact on reputation and/or on operational efficiency/continuity and sustainability, measured on a scale from “minor” (1) to “very high” (4);

- Likelihood, probability that a particular event may occur, measured on a scale from “remote” (1) to “probable” (4);

- Risk Management Capability, meaning the maturity and effectiveness of existing risk management systems and processes (including controls), measured on a scale from “adequate” (green) to “inadequate/non-existent” (red).

Following the identification and assessment of risks and opportunities, Group exposure is analysed taking into account the future risk and opportunities evolution and outlook (i.e., the possibility that exposure increases, remains constant or decreases over the period considered).

The outcome of the risk assessment is then represented on a 4x4 heatmap, which, by combining the variables in question, provides a clear overview of the most significant risk events.

In particular, sustainability and climate related risks and opportunities are also assessed and reported, taking into account the Group’s latest update of its double materiality matrix for the purposes of the Integrated Report.

Risk and opportunity management

Toggle DetailsThe overview of the Group’s risks and opportunities allows the Board of Directors and Top Management to evaluate the Group’s risk appetite and identify the risk and opportunity management strategies to adopt, by assessing and prioritising the types of risk for which it is deemed necessary to implement, improve or optimise mitigation actions and those for which it is sufficient to monitor the exposure over time.

Risk and Opportunity deep dives

Toggle DetailsTo allow a full coverage of the risks and opportunities to which Prysmian is exposed, risk and opportunity analyses are also carried out through specialised deep dives (e.g. new emerging risks, operational risks, climate change risks). Below are examples of risk & opportunity deep dives performed in Prysmian.

Operational risks - focus on Project risk

At Prysmian, the assessment of operational risks is an integral part of the Enterprise Risk Management activities. Departments, Functions and Business Units at all levels, involved in producing and/or delivering products/projects/services to clients, are identified as Risk Owners, being primary responsible for timely identifying, assessing, managing and monitoring risks in day-to-day operations and throughout each product/project/service life cycle.

In particular, to effectively manage risks related to the Business Unit Transmission, Prysmian has implemented a systematic Project Risk Management Process, integrated in Prysmian’s Project Management activities of Transmission segment, during the whole project lifecycle (from bidding to delivery phases). Project Risk Management System is aimed at ensuring expected projects performances, by effectively managing risks during the whole project lifecycle and timely identifying mitigation actions, also promoting proactive and transparent behaviours by all actors involved in risk assessment.

Risk assessment activities, as well as risk management, mitigation and monitoring actions are clearly assigned based on each function’s area of competence / expertise, including escalation mechanisms to Top Management and relevant Committees depending on risk evolution and exposure.

Climate Change risks

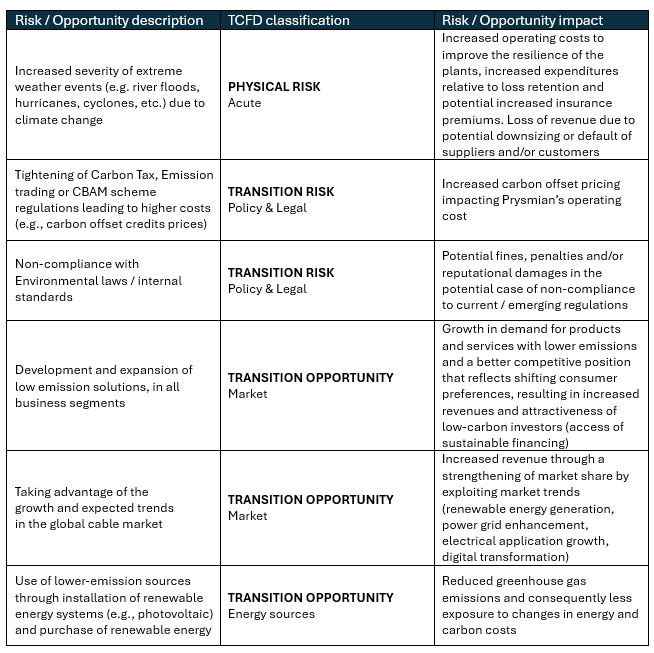

In response to global trends related to climate change, Prysmian has developed analysis on the Group exposure to climate-related risks and opportunities. This deep-dive analysis, aligned with key international standards and frameworks (e.g., TCFD, IPCC, IEA), enables the identification, assessment, and management of climate-related risks. Prysmian considers both physical risks and transition risks and opportunities.

The analysis of climate change-related risks and opportunities is fully integrated into the Group’s centralized Enterprise Risk Management system - addressing multi-disciplinary areas and covering the Group with a company-wide perspective - with the aim of considering all relevant categories of risks and opportunities, including those related to climate change, and ensuring continuous alignment between risk assessments and the Group’s short-, medium-, and long-term strategic objectives.

To explore and assess the resilience of its business to climate change, Prysmian periodically conducts an analysis on physical and transition risks involving various climate-related scenarios, including a 2°C or less temperature increase, in order to model how the impact and likelihood of the material risks and opportunities identified might change from time to time. In particular, the Group considers two types of models: IPCC RCP scenarios for the physical risk assessment (IPCC RCP 8.5; IPCC RCP 2.6) and IEA Scenario for transition risks and opportunities (IEA STEPS; IEA APS; IEA NZE).

The climate-related risk and opportunity analysis is performed over three different time horizons:

- Short-term (1 year);

- Medium term (2-5 years);

- Long term (more than 5 years).

Climate risk and opportunity analysis is carried out across the Group’s own operations as well as throughout the value chain, both upstream and downstream. The analysis is performed considering all types of climate related risks and opportunities as per TCFD Classification including physical risks (acute and chronic risks) and transition risks and opportunities (e.g., policy & legal / regulations, technology, market, reputation).

By analyzing various climate scenarios, Prysmian assesses the adequacy of its strategy in terms of resilience against physical risks, deriving from climate change as a cause of acute events or from chronic changes in climate patterns, and against transition risks, relating to a transition to a low-carbon economy.

Below are Prysmian's material climate-related risks and opportunities

Focus on risks driven by changes of physical climate parameters or other climate change related matters - Increased Severity of extreme weather events

With regards to physical risks directly related changes of physical climate parameters or other climate change matters, Prysmian considers - among others – risks related to the increased severity of extreme weather events, such as hurricanes and floods, or long-term chronic weather conditions, such as persistent high temperatures causing sea level rise or more intense heat waves.

Climate related risks are generally described as the potential failure to adapt to climate-related events that could cause disruptions in Prysmian’s operations and value chain (e.g. causing difficulties in the supply chain of key materials).

With a widespread geographical presence across different countries, Prysmian’s potential exposure is amplified by its broad geographic coverage. Extreme weather events could also potentially lead to critical issues in mining operations, causing greater difficulties in raw material sourcing. In addition, due to the lack of infrastructure, some mines located in developing countries would be more exposed to the risks of extreme weather events, leading to additional procurement difficulties if they fail to adapt to climate-related events. In addition, some key resources could be severely affected during extreme weather events.

Risks related to the increased severity of extreme weather events are periodically assessed from a financial, operational, sustainability and reputational perspective.

Specifically, from a financial perspective, the analysis is conducted using dedicated tools (e.g. CatNet®, a geo-specific risk exposure profiling tool developed by Swiss Re, and Aqueduct, a web-based platform developed by the World Resources Institute) which enable Prysmian to assess the exposure to these risks. In the case of new operations, specific climate change risk assessment are carried out, geo-localizing new plants and other relevant locations.

Prysmian periodically verifies the robustness of its resilience and evaluates the appropriate countermeasures to be taken for production assets, including considering their expected lifespan and the supply chain.

Main financial implications related to climate related risks are financially assessed considering damages to assets, reduction in resources availability (e.g. water) and triggering of operational disruptions throughout the value chain.

As for the financial assessment, the exposure to different events (e.g. river flood, pluvial flood, coastal flood, tornado, windstorm, hailstorm, wildfire, lightning, landslide) is assessed, determining the residual risk also based on insurance limits and deductibles defined for each event and plant.

Emerging risks

To ensure that the ERM process is capable of identifying and managing all risks to which Prysmian may potentially be exposed during its business activities, a dedicated focus on emerging risks is conducted as part of the risk management activities.

The identification of emerging risks is carried out through periodical interviews with Top Management and Business functions, as well as through the analysis of key reference sources such as reports and market studies which provide insights into major forward-looking trends relevant to Prysmian's business context.

Below are some examples of emerging potential risks examined in the medium-long term:

- Escalating tariffs and trade war - Tariffs and trade policy changes can potentially impact global markets, disrupting supply chains and increasing the cost of doing business globally

- AI-Enhanced Cyber Attacks – Potential increase of the effectiveness of Cyber-attacks resulting from the ease use of AI-assisted tools for code generation, attack automation, phishing and other attempts by malicious actors. This risk can potentially generate reputational impact (e.g., mining stakeholders’ trust), operational impact (e.g., business interruptions) and /or economical impact (e.g., additional costs for attack responses).

- Misuse of AI - Potential use by employees of unauthorized AI tools and/or applications outside of the Group approved framework, which can lead to compliance issues, loss of intellectual property and/or reputational damage.

Audit and continuous improvement

Toggle DetailsPrysmian is committed to the continuous improvement of its Risk Management system. As part of this commitment, the Group's Enterprise Risk Management (ERM) process has been subject to third-party assessments and audits for multiple purposes.

Between 2023 and 2024, Prysmian underwent an Enterprise Risk Maturity Assessment conducted by an independent third party to evaluate the maturity level of the Group’s risk management system against leading international frameworks, identify key areas for improvement based on the desired target state, incorporate industry best practices, and benchmark the system against peer organizations. Following the assessment, Prysmian implemented of improvement actions, in alignment with its continuous improvement approach.

In 2024 - 2025 the Risk Management Process was also included in audit activities carried-out by the Group Quality Department, external certification bodies (e.g., as part of the ISO 9001 certification renewal process) and other external parties (e.g., external audit with focus on Project Risk management for Transmission Business Unit).