Prysmian prepares for its big offshore push

Source: Recharge, Global Offshore Wind Special Edition (June 2018) - D. Sniekus

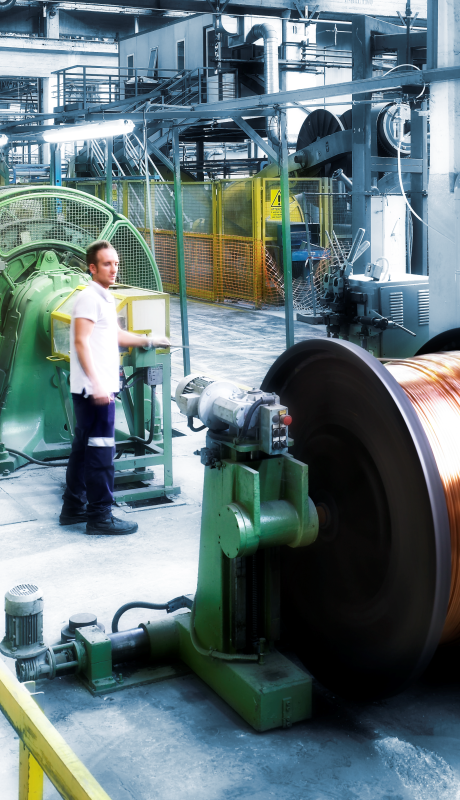

The scale of Europe’s offshore power interconnection prize — 20,000 km of new cabling needed by early next decade — is proving epic enough to keep Prysmian’s foot on the investment pedal despite a leaner few years for the sector than expected.

The looming proliferation of high-voltage interconnections between nations and larger offshore wind farms further from shore have convinced Prysmian to sign off on a second major capital investment in five years to build a €170 m ($198 m) state-of-the-art cable-laying supership, retool its manufacturing lines for 66kV high-voltage technology, and stage a $3bn takeover of US rival General Cable.

The new, as-yet-unnamed, cable-lay vessel will ultimately replace veteran Giulio Verne, which has been in operation since 1985 and now has“a few grey hairs”, Raul Gil, Submarine Power Business Leader, tells Recharge.

On track for christening in the second half of 2020, the ship will set a new standard for “capacity and capability” with twin 7,000-tonne cable carousels, robotic trenching and burial vehicles, a top speed of 12 knots (22km/h) and an ability to install lines in water depths down to 3km.

“The new ship will be the most state-of-the-art on the market by far — faster on transits, faster on installation of all types of cable”

Raul Gil

Submarine Power Business Leader

The vessel may sail straight out into one of the biggest, and most delayed, projects off Europe, the 1.4 GW Denmark-to-UK Viking Link — one of a clutch of large interconnectors Prysmian is currently handling, including the 1.4 GW North Sea Link between Norway and the UK, the France-UK ElecLink and IFA2 lines, and the Scotland-Wales UK Western Link. But Gil says the new flagship will boost its capabilities in the offshore wind sector as well as in major transnational projects.

The vessel will be able to do better some of the smaller offshore wind projects we are doing now with other Prysmian vessels

“It will be able to lay cables with fewer joins because of the greater carousel capacity and more flexibility because it will be able to do simultaneous laying and burial operations — which will solve some of the problems the industry has seen where a cable is laid but then left exposed on the seabed and is then damaged by fishing boat anchors and other things.”

The latest round of investment is an expression of strategic faith by Prysmian in a subsea cable sector that has not so far expanded “quite as fully” as its earlier expectations of an annual market of up to €3 bn suggested.

The 2016-17 market lagged behind the average €2.3 bn seen since 2010 and the current year is likely to only match that average level, dragged down by delays to some big interconnector projects.

Anyway, Mr. Gil insists it would be a mistake to make decisions on the basis of a couple of “relatively weak” years, rather than looking at the longer-term picture. “I think it is one of the things that we do wrong in this industry,” he says. “Every company has its ways of managing market risk — the market has ups and downs, we know this. You complete a project in December and it is a good year; complete it in January and this is not so. It is important to see the macro trend and the macro trend is positive.”

Prysmian has a solid €1.9 bn order backlog to work with. It has also seen enough of Europe’s offshore power trajectory to stick with an investment strategy that saw it spend €250 m between 2012 and 2016 to upgrade manufacturing facilities in Finland, Norway and Italy, and retool the Cable Enterprise, Giulio Verne and Ulisse vessels.

The big prize, says Gil, lies in the post-2020 offshore wind construction boom that will see multi-gigawatt-scale projects spring up in European seas.

“In manufacturing terms, the projects to be undertaken from 2020 will benefit from the growth of the offshore wind market today. The auctions last year and this year are becoming orders for us this year and next and then into the 2020s.”

Prysmian is also reinventing itself to feed a growing appetite among TSOs and developers for a “one-stop-shop” in cable supply.

“We are carrying on with our strategy to move into a role in EPC [engineering, procurement and construction] for offshore wind,” - says Gil - “The market can see Prysmian as a cable manufacturer, but we see ourselves as turnkey now. We have three cable-lay vessels, we have a broad range of installation technology, we have a long track record of experience on subsea cables — going back to our telecommunication-line days — and we are showing we can manage all the interfaces on power infrastructure projects"

“We are not an integrator that buys everything: we do everything. And by ‘internalising’ parts of the supply chain we used to outsource, we can also make these revenue streams rather than costs.”

This model had a first outing at Germany’s 350MW Wikinger offshore wind farm, where Prysmian managed a project scope for developer Iberdrola that stretched from manufacturing to installation of the interarray lines at the Baltic Sea site. With the plant now on line, it will shift into O&M services for the power systems.

Wikinger, which was grid-connected at the end of 2017, represented a major learning curve for Prysmian as it added interarray cabling to its established skill set.

“We have a new level of understanding as to the differences of interarray EPC with export and interconnectors — there is a different kind of complexity but [it] also depends more on repeatability, so in some ways it is easier too because once you lay one interarray line you know more about how to lay the next one, and so on” states Gil.

“And managing the project interfaces in-house is definitely easier for us, because we do it this way already for export line projects and interconnectors. It also means we can add more value for the customer.”

Playing the long game is something Prysmian, whose corporate roots stretch back to the first transatlantic telegraph-line laying campaigns of the 1900s, understands well, says Gil. He claims this experience allows a company to spot certain market patterns as they emerge — cost-reduction, new technology, consolidation — all of which are highly relevant in the offshore wind industry.

“The largest surprise in the last five years is, of course, how the cost of energy of offshore wind has been brought down so quickly and so low. This has been a game-changer for us all. We are not yet there, but imagine — that countries can soon have offshore wind energy at the prices that are cheaper than ‘old’ sources of energy.”

There are still risks ahead, he acknowledges, including the potential disruptive effect on offshore wind’s economics if power prices fail to rise to a level that makes zero-subsidy projects as viable as expected.

But with Wikinger pointing the way forward for Prysmian, its confidence in the sector is as high as ever.

“We must recognise that the industry to this point has not been mature. Now we are reaching maturity. We are very optimistic over how this market is developing.”

MAKE IT PROGRAM

Make It: Good people make great companies

CORPORATE

Prysmian reinforces its digital presence

CORPORATE

Staying the course, in the UK

FAST TRACK PROJECT

The future starts in Calais, Prysmian’s first 4.0 factory

POWER GRIDS

Prysmian joins Tesla’s renewables challenge

FT-ETNO SUMMIT 2017

Debating the connectivity of tomorrow

GRADUATE PROGRAM

Prysmian CEO welcomes 50 young hired

PEOPLE