Prysmian starts the year positively with revenue growth, solid margins and outstanding cash generation

- ORGANIC GROWTH AT 5% IN Q1’25. ADJ. EBITDA GROWS BY +27.9% TO €527 MILLION INCLUDING THE CONTRIBUTION FROM ENCORE WIRE. SOLID MARGIN1 AT 13.1% (12.4%, Q1’24)

- EXCELLENT PERFORMANCE IN TRANSMISSION, WITH OUTSTANDING ORGANIC GROWTH (+57.2%) AND PROFITABILITY IMPROVEMENT (16.9% MARGIN VS. 13.1% Q1’24)

- ROBUST MARGIN IN POWER GRID CONFIRMED (15.2% VS. 14.8%, Q1’24)

- RECOVERY IN ELECTRIFICATION IS UNDERWAY WITH THE I&C MARGIN REACHING 11.6%

- DIGITAL SOLUTIONS MAKES A POSITIVE START TO THE YEAR WITH AN INCREASE IN REVENUES (+3.4% ORGANIC GROWTH) AND PROFITABILITY (13.2% MARGIN VS. 10.8% Q1’24)

- EXCELLENT CASH GENERATION WITH THE FREE CASH FLOW LTM REACHING APPROX. €1 BILLION

- PERCENTAGE OF SUSTAINABLE REVENUES REMAINS SOLID (42.9%), WHILE THE USE OF RECYCLED CONTENT GROWS BY 2.6 P.P. VS. Q1’24 TO 18.8%, THANKS TO STRONG CIRCULAR ECONOMY COMMITMENT

- FY 2025 OUTLOOK CONFIRMED. ACQUISITION OF CHANNELL COMMERCIAL CORPORATION ON TRACK WITH THE CLOSING EXPECTED WITHIN THE SECOND QUARTER

Massimo Battaini, Prysmian CEO, said: “Prysmian closed the first quarter of the year with solid margins, together with outstanding cash generation, and during this quarter we also shared our medium-term targets at the Capital Markets Day in March, setting the direction for organic growth driven by our long-term evolution from cable manufacturer to solutions provider. These set of results demonstrate continued progress towards our strategic targets, as seen by the excellent performance in the Transmission business, together with the continuous improvement in Digital Solutions, which will be further enhanced by the acquisition of Channell, that is on track to close in the second quarter. The results that we have achieved also allow us to confirm our 2025 guidance, despite the uncertain macroeconomic scenario, as we focus on accelerating growth and profitability in the months ahead.”

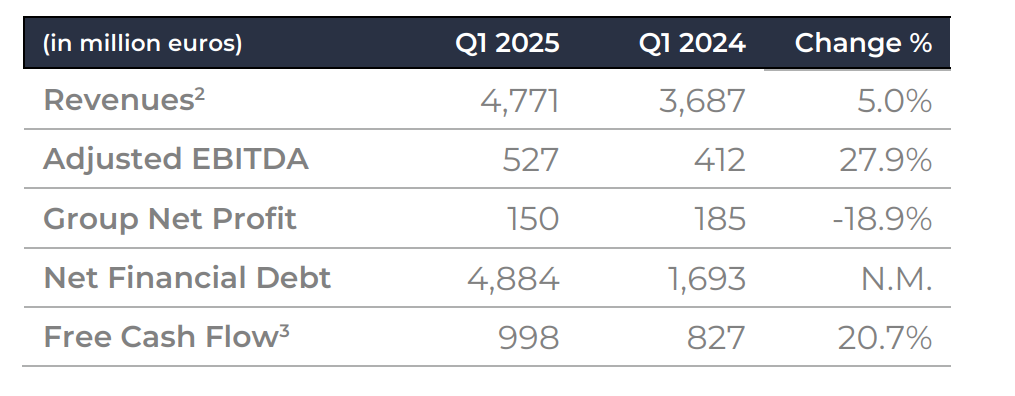

FINANCIAL HIGHLIGHTS

The Board of Directors of Prysmian S.p.A. has approved the Group’s consolidated results for the first quarter of 2025.

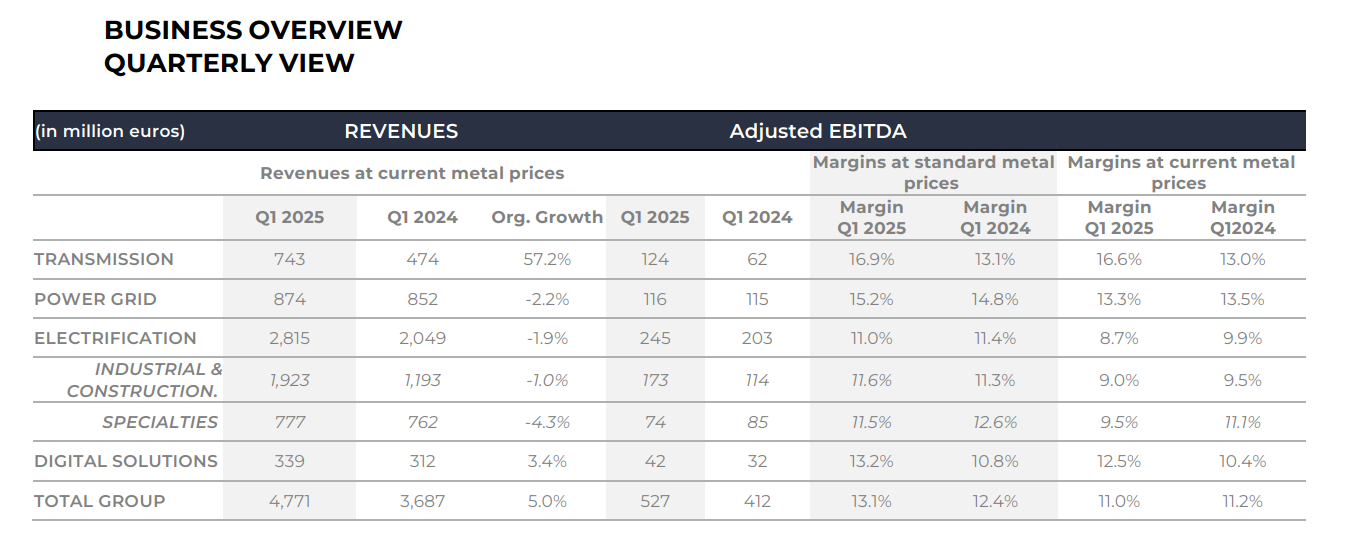

Group Revenues4 stood at €4,771 million in Q1’25, up from €3,687 million in Q1’24 with a +5.0% organic growth. This growth was mainly driven by Transmission, together with the positive contribution from Digital Solutions, which more than offset the performance of Power Grid and Electrification.

Adjusted EBITDA reached €527 million, up 27.9% compared to €412 million in Q1’24.

The overall margin was up 0.7 p.p. to 13.1% (12.4%, Q1’24).

The Transmission business doubled its Adjusted EBITDA to €124 million in Q1’25 (€62 million, Q1’24), with an improved margin at 16.9% (13.1%, Q1’24).

Power Grid continued to deliver solid profitability, with the Adjusted EBITDA at €116 million, and the margin at 15.2% (14.8%, Q1’24).

In Electrification, the Adjusted EBITDA of Industrial & Construction, which includes the contribution of Encore Wire from Q3’24, rose to €173 million, (€114 million, Q1’24) and the margin was 11.6% versus 11.3% in Q1’24.

There was sequential improvement in Specialties, with the Adjusted EBITDA reaching €74 million. v Digital Solutions enhanced profitability, with the Adjusted EBITDA at €42 million (€32 million, Q1’24) and the margin at 13.2% (10.8%, Q1’24).

EBITDA increased to €507 million (€393 million, Q1’24).

Net profit was €155 million (€150 million attributable to Group shareholders) versus €190 million (€185 million attributable to Group shareholders) in Q1’24. The €35 million decrease was mainly due to higher depreciation and amortization (also including the effect of Encore Wire purchase price allocation), a negative change in commodity derivatives at fair value and higher net finance costs following the acquisition of Encore Wire. These effects were partially offset by the increased EBITDA and lower taxes.

Free Cash Flow LTM rose to €998 million, substantially in line with the Free Cash Flow of the full year 2024 (€1,011 million).

Net Financial Debt increased to €4,884 million from €1,693 million on March 31 2024. The increase mainly reflects:

- the acquisition of Encore Wire and Warren & Brown (+€4,126 million);

- the conversion of the Convertible Bond completed in July 2024(-€733 million) partially offset by the share buyback launched in June 2024 (+€376 million);

- the dividend to shareholders paid in April 2024 (+€193 million);

- the Free Cash Flow earned in the last twelve months for €998 million generated by:

- €1,557 million in net cash flow provided by operating activities before changes in net working capital;

- €479 million in net cash flow provided by changes in net working capital;

- €847 million in cash outflows for net capital expenditure;

- €210 million in payments of net finance costs;

- €19 million in dividends received from associates.

1 Starting from Q1’25 Prysmian will report in the press release the Adjusted EBITDA margin at standard metal prices. This decision has been made to enhance the understanding and comparison of results across different periods. The calculation of standard metal prices takes into account standard prices for copper (€5,500 per ton), aluminium (€1,500 per ton) and lead (€2,000 per ton) to remove the volatility from market fluctuations in metal prices. All references to margins in this press release refer to the Adjusted EBITDA margin at standard metal prices unless otherwise stated.

2 Change % as organic growth. Growth in revenues calculated net of changes in the scope of consolidation, changes in metal prices and exchange rate effects. As per 2025 organic growth calculation, Encore Wire has not been considered a change in scope of consolidation, so the organic growth has been calculated by including Encore Wire’s revenues in the corresponding 2024 period on a pro-forma base.

3 FCF LTM (last twelve months) excluding Acquisitions & Disposals and Antitrust impact.