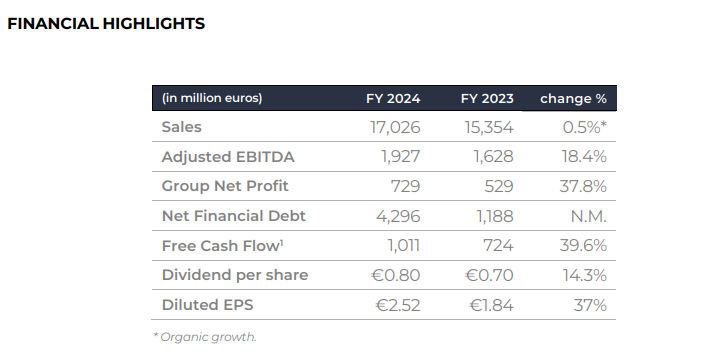

PRYSMIAN CLOSES THE YEAR WITH EXCELLENT CASH GENERATION, MARGIN EXPANSION AND ORGANIC GROWTH

- EXCELLENT CASH GENERATION WITH FREE CASH FLOW AT €1,011M (+39.6%), AND THE FREE CASH FLOW YIELD AT 6.3%

- FULL YEAR ADJ. EBITDA AT €1,927M (+18.4%), WITH AN EXCELLENT MARGIN AT 11.3%

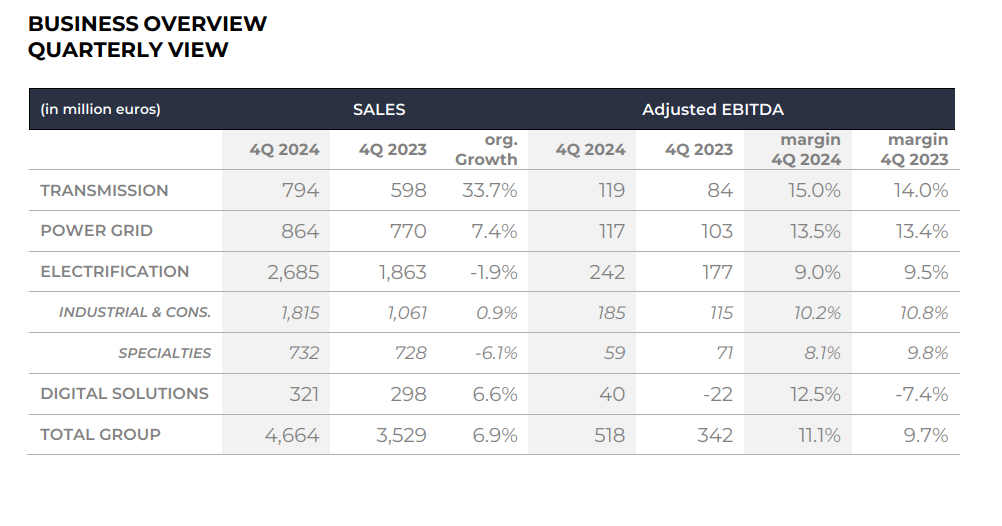

- ORGANIC GROWTH IMPROVES IN Q4, UP TO 6.9%

- OUTSTANDING GROWTH (+33.7%) AND PROFITABILITY (15.0% ADJ. EBITDA MARGIN) IN TRANSMISSION IN Q4

- POWER GRID DELIVERS SOUND ORGANIC GROWTH (+7.4%) AND EXCELLENT MARGIN (13.5%) IN Q4

- ACHIEVEMENT SUPPORTED BY THE STRONG PROGRESS IN CARBON EMISSION REDUCTION & THE INCREASE IN SALES OF SUSTAINABLE PRODUCTS AND SOLUTIONS (43.1%)

- FOCUS ON SHAREHOLDER REMUNERATION WITH THE PROPOSED DIVIDEND UP TO €0.80 (+14.3% vs. 2023)

- FY 2025 OUTLOOK:

- Adjusted EBITDA expected in the range of €2,250M–€2,350M

- Free Cash Flow expected in the range of €950M–€1,050M

- Scope 1&2 GHG emission reduction expected in the range of -38% and -40% vs. 2019

Massimo Battaini, Prysmian CEO, said: “This outstanding set of results is a springboard for future success. The market drivers behind our business are solid, and Prysmian has never been in a better position to take full advantage of the opportunities for profitable, and sustainable growth. Prysmian’s financial structure is robust, underlined by outstanding cash generation, while at the same time, we can further enhance the remuneration to our shareholders thanks to the improved dividend per share. In 2024 Prysmian made its largest ever acquisition, Encore Wire in the United States, which has helped to surpass in advance the delivery of our mid-term financial targets. These results are also thanks to our leadership mindset that is enabling us to innovate and think beyond the status-quo. Today Prysmian is a global reference point in electrification, energy security & transition and digitalisation, and thanks to the efforts from all our colleagues worldwide, we will be ready to share our new targets, built on this track-record of delivery, next month at the Capital Markets Day in New York City.”

Milan, 27th February 2025 - The Board of Directors of Prysmian S.p.A. have approved the Group’s consolidated results for 2024.(2)

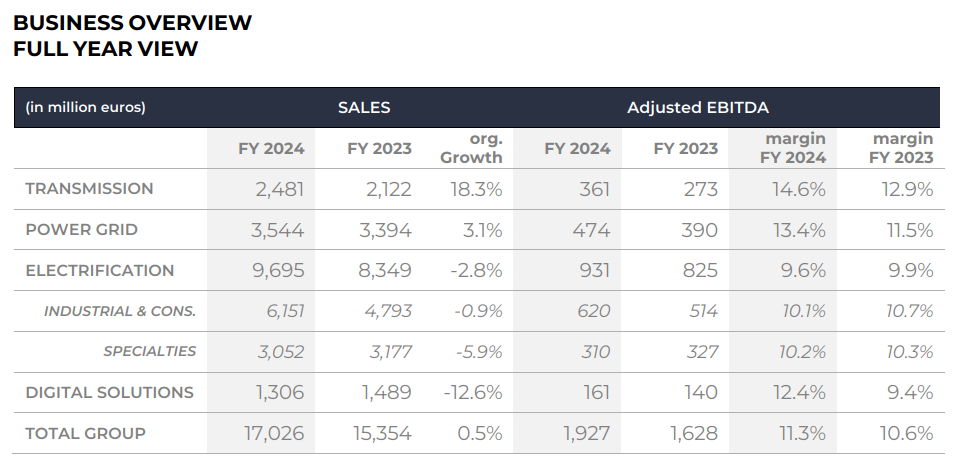

Group Sales amounted to €17,026 million, with a 0.5% organic growth. The result was driven by Transmission (+18.3% organic growth) and Power Grid (+3.1% organic growth), which offset the contraction in Electrification (-2.8% organic growth, mainly driven by Specialities) and Digital Solutions (-12.6% organic growth). In the fourth quarter there was an increase in organic growth, which rose to 6.9%. This result was led by Transmission (+33.7% organic growth) together with the contributions from Power Grid (+7.4% organic growth), and Digital Solutions (+6.6% organic growth).

Adjusted EBITDA grew 18.4% to reach €1,927 million (€1,628 million, FY23), with the margin increasing to 11.3% (10.6%, FY23). Profitability in Transmission rose to reach an excellent €361 million (€273 million, FY23), with the adjusted EBITDA margin increasing 1.7 p.p. year on year to stand at 14.6%. In Power Grid, there was also a strong increase in profitability for the full year 2024, with the adjusted EBITDA rising to €474 million (€390 million, FY23), and the adjusted EBITDA margin standing at 13.4% (11.5%, FY23). In Industrial and Construction, the adjusted EBITDA rose to €620 million, up from €514 million at FY23 also reflecting the consolidation of Encore Wire, as of 3Q24, while the adjusted EBITDA margin stood at 10.1%. In Specialties, the adjusted EBITDA was €310 million, down from €327 million at FY23, mainly due to the automotive business. The adjusted EBITDA margin was substantially stable at 10.2% (10.3%, FY23). In Digital Solutions, the adjusted EBITDA, rose, as well as the adjusted EBITDA margin, increasing to €161 million (€140 million, FY23) and 12.4% (9.4%, FY23), respectively.

EBITDA was €1,754 million (€1,485 million, FY23), including net expenses for company reorganisations, non-recurring expenses, and other non-operating expenses of €173 million (€143 million, FY23), of which €77 million was related to the acquisition of Encore Wire.

Net profit stood at €748 million (€547 million, FY23). Net profit attributable to owners of the parent company amounted to €729 million (€529 million, FY23), driving a significant increase in diluted earnings per share, up to €2.52 (€1.84 per share in 2023).

Free Cash Flow rose to €1,011 million, compared to €724 million at FY23.

Net Financial Debt increased to €4,296 million from €1,188 million at FY23, this reflected, among others:

- the acquisition of Encore Wire and Warren & Brown (+€4,126 million impact);

- the conversion of the Convertible Bond completed in July (-€733 million) partially offset by the share buyback launched in June (+€328 million);

- the dividend to shareholders paid in April (+€202 million);

- the free cash flow of €1,011 million generated by:

- €1,457 million in net cash flow provided by operating activities before changes in net working capital;

- €465 million in net cash flow provided by changes in net working capital;

- €785 million in cash outflows for net capital expenditure;

- €142 million in payments of net finance costs;

- €16 million in dividends received from associates.

TRANSMISSION

Thanks to the smooth execution of projects, as well as projects with improved margins, the Transmission business grew in terms of sales and profitability, at both the full year and in the fourth quarter of the year. Transmission grew thanks to an organic growth of 18.3% at FY24 to reach €2,481 million (€2,122 million, FY23), while in the fourth quarter, there was an excellent improvement in organic growth (+33.7%), to total €794 million.

The adjusted EBITDA also rose for both the full year and in the fourth quarter, at €361 million and €119 million, respectively. The adjusted EBITDA margin increased at full year 2024 to reach 14.6% (+1.7 p.p.), while in the fourth quarter, it rose to 15.0%.

The backlog remained substantially stable at approximately €17 billion.

POWER GRID

Sales increased to reach €3,544 million, thanks to a 3.1% organic growth at full year 2024. In the fourth quarter there was an acceleration in organic growth up 7.4% with total sales at €864 million. In line with Prysmian’s journey from cable manufacturer to solutions provider, 25% of total sales in Power Grid were from solutions.

There was margin improvement at the full year, increasing 1.9 p.p. to reach 13.4%. In the fourth quarter the adjusted EBITDA margin was 13.5%.

Overall profitability was up, with the adjusted EBITDA increasing to €474 million (€390 million, FY23) at the full year, and €117 million (€103 million, 4Q23) in the fourth quarter.

ELECTRIFICATION

Industrial & Construction

Sales in the Industrial and Construction segment in the fourth quarter, stood at €1,815 million, with a 0.9% organic growth, with Encore Wire consolidated within this business starting from 3Q24. At FY24, sales were €6,151 million, from €4,793 million at FY23, with a -0.9% organic growth. The adjusted EBITDA rose to €620 million (€514 million, FY23) at FY24, and in the fourth quarter to €185 million (€115 million, FY23). The adjusted EBITDA margin was 10.1% at FY24. In the fourth quarter the adjusted EBITDA margin was 10.2%, reflecting, as expected, seasonality.

Specialties

Sales in the Specialties segment were €3,052 million, with a -5.9% organic growth compared to FY23. In the fourth quarter, sales stood at €732 million, with a -6.1% organic growth. In the fourth quarter the adjusted EBITDA margin was 8.1% (9.8%, 4Q23), and the adjusted EBITDA was €59 million (€71 million, 4Q23), reflecting a continued slowdown in the automotive business. At FY24, the adjusted EBITDA was €310 million (€327 million, FY23) and the adjusted EBITDA margin was substantially stable at 10.2%.

Regarding the overall Electrification segment, the adjusted EBITDA at FY24 was €931 million, (€825 million FY23) with the margin at 9.6% (9.9%, FY23). The overall sales at FY24 were €9,695 million (€8,349 million, FY23).

DIGITAL SOLUTIONS

As expected, the progressive recovery in Digital Solutions continued. At full year 2024, Digital Solutions strengthened profitability, rising to an adjusted EBITDA of €161 million (€140 million, FY23) and the adjusted EBITDA margin was up by 3 p.p. to reach 12.4%.

There was a significant improvement in fourth quarter profitability, with the adjusted EBITDA 5 margin standing at 12.5%, up from -7.4% at 4Q23, and the adjusted EBITDA at €40 million, up from €-22 million in the fourth quarter of 2023. Overall sales were also up in the fourth quarter to reach €321 million, with a +6.6% organic growth, while at the full year, there was a -12.6% organic growth, to bring sales to €1,306 million.

The long-term growth drivers for the Digital Solutions business remain positive, driven by massive data growth as well as the increase of FTTH, 5G coverage and datacentres. Prysmian is well-positioned to seize the opportunities offered by digitalisation.

DOWNLOAD THE FULL PRESS RELEASE